Calendar Year For Taxes – The income tax department has published a comprehensive tax calendar on its website at source to employees for salary paid and tax deducted during the Financial Year 2023-24. June 29, 2024 The due . starting July 1 of the year following the end of the calendar year after the tax arose. The form requires the investor to report the fair market value of the investment on the date it became .

Calendar Year For Taxes

Source : www.investopedia.com

What Is a Tax Year?

Source : www.thebalancemoney.com

Fiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.com

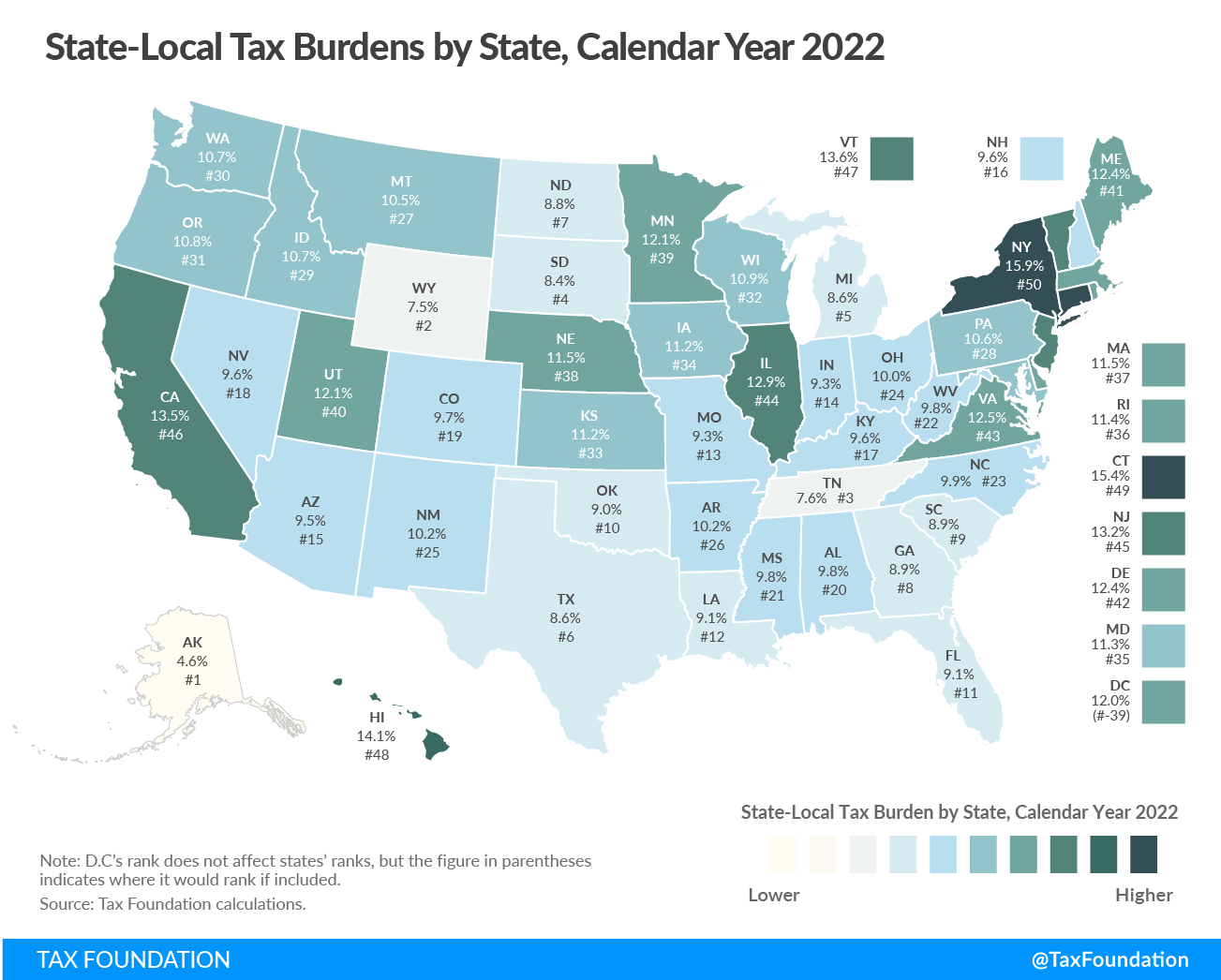

State and Local Tax Burdens by State | Tax Foundation

Source : taxfoundation.org

Property Tax Prorations Case Escrow

Source : caseescrow.com

State and Local Tax Burdens by State | Tax Foundation

Source : taxfoundation.org

IRS Tax Timeline 2014 Infographic Guide – Critical Dates

Source : defensetax.com

2020 Q4 tax calendar: Key deadlines for businesses and other employers

Source : mordfin.com

Handy Property Tax Calendar for Santa Clarita Homeowners

Source : gregoryrealestategroup.com

How Choosing Your Fiscal Year Affects Your Business Taxes Indinero

Source : www.indinero.com

Calendar Year For Taxes What Is the Tax Year? Definition, When It Ends, and Types: In this article, we will navigate through the June 2024 compliance calendar for GST returns, which includes term GST returns, important due dates, forms to be filed, periods, and taxpayers. What is a . “Taxpayers have extra time – up to six months after the due date of the taxpayer’s federal income tax return for the disaster year (without regard to any extension of time to file) – to make the .

:max_bytes(150000):strip_icc()/taxyear-c3f5618cd504499583b0543cb4d6b31e.jpg)

:max_bytes(150000):strip_icc()/tax-year-defined-1293735_final_rev_3_25_21-92ca8c2a3f9c4515ad8b71d04f4d4b0d.png)

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)